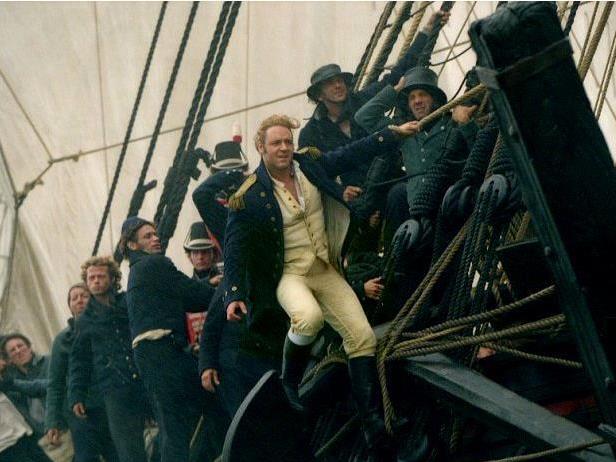

Rupert Murdoch’s swashbuckling days in film production are over. Image: Master and Commander, produced through 20th Century Fox in 2003.

Disney is taking the carving knife to the Murdoch empire to acquire half of Endemol Shine, all of Sky in Europe, Indian companies Star and Tata Sky, and the 20th Century Fox Studio assets. As far as I can tell, Star Greater China and Fox International Channels Asia are part of the deal, so the family is out of Europe, Latin America and Asia but hanging on in North America, Britain and Australia. It is an English language empire and the Murdochs are beating the retreat.

This is an enormous deal, larger than anything the Murdoch family has done before, and adds up to US$52.4b.

All of this is in stock, with the 21st Century Fox debts of US$13b on top. It means that Lachlan remains in the family company while James is transferred to Disney, backed by whatever power the family has as part of a much larger shareholder base. Elisabeth, the clever one, remains a ghostly figure.

The Murdochs were a print family for two generations, until Rupert realised that media could be seen as one unified world, and burst into film and television in a relentless crusade which would consume him for forty years and give him fantastic and malignant power. News Ltd owned all of 20th Century Fox by 1984, and used it as a base to launch Fox Broadcasting Company, which is a FTA and cable network. It then set up the Sky Television Satellite Network in the UK, lost a lot of dosh, sold magazines and went on the march again by buying Star TV in Hong Kong. A year later it started Foxtel with Telstra and PBL, and then started the Fox News Channel on US cable.

You have to remember that Newscorp was a publically traded company, which had two classes of shares which enabled the Murdoch family to exert control while owning much less than half of the company. Nice work if you can get it.

In 2013 the Murdochs split Newscorp in two. The News Corporation ended up with the publishing assets, while the other half was called 21st Century Fox, officially run by Rupert who is also the chair of both organisations. They are publicly listed companies though leadership continues to be suffused with the Murdochs through the two sons.

James Murdoch is chairman of Sky plc and 21st Century Fox. Lachlan is executive co-chairman of 21st Century Fox and co-chair of News Corp. Elisabeth seems to be floating.

21st Century Fox is going to be split again, so that the Fox broadcasting assets like Fox News are hived off into a separate company to be called New Fox. The ABC drily calls this ‘spun off to its shareholders’, although these will all be voting shares so ordinary holders of scrip will finally have some say in their destiny.

Disney gets the rest, which includes a LOT of rights including Titanic and Avatar, and The Simpsons. Marvel gets back the bits of its material owned by the Murdochs because it too is owned by Disney. The mouse company can use that IP to set up its own streaming network to go head to head with Netflix.

James Murdoch is parcelled off and sent to Disney to work on stitching it all together. The Murdochs end up owning a chunk of Disney. All of 4%, while the total shareholding will be around a quarter. This is a fascinating situation in itself as it makes Rupert Murdoch the single biggest shareholder just ahead of Lorraine Powell Jobs, the widow of Steve Jobs and the inheritor of that deal by which Pixar was sold to Disney in the same way.

The plus side is that Disney is the largest entertainment company in the world while the shareholders may finally be free of the Murdoch machinations including their politics.

The Murdochs claim to be walking away from the hard bits of the media landscape, and to hang on to the parts where they can be really nasty, though they don’t put it like that. Even though some of the sports assets will pass to Disney, the new company expects to focus on news and sport. In other words, they have kept the bits that allow them to play power games and ditched the rest. Think Fox News and Fox Business.

As the Disney release says,

Disney’s international reach would greatly expand through the addition of Sky, which serves nearly 23 million households in the UK, Ireland, Germany, Austria and Italy; Fox Networks International, with more than 350 channels in 170 countries; and Star India, which operates 69 channels reaching 720 million viewers a month across India and more than 100 other countries.

The deal dramatically changes the Murdoch’s fight to take over Sky UK because the family will never control it. Disney expects this piece of the empire to be part of the deal, if it succeeds.

In Australia there will not be much direct public impact. News Corp still owns half of Foxtel and part of REA Group. But Disney will now have a toehold back in Australia through Shine Endemol for the first time since it closed Disney Toons in 2006.

While that company specialises in reality TV, the international Shine Group owns a huge number of different production companies, many of which are in high end drama, so there is nothing to stop Disney from changing the DNA of Shine Endemol towards drama as well. However, Disney will actually share ownership of the company with American private equity firm Apollo Global Management which is responsible for US$232b in assets.

The real implications are international. Disney takes over all of Marvel, owns Pixar, has merged with Lucasfilm, and is a massive tentpole creator in its own right. It was already the biggest player in Hollywood with 26.1% of the US market in 2016 and gains an extra 12.9% from 20th Century Fox. It owns the ABC network. We can expect it to organise its supply chain of major pictures to reduce competition, stabilise the industry and avoid cannibalising its audience.

It is now the majority shareholder in the jointly owed Hulu.

In a sense, the Murdochs and Disney have made opposite bets. The family has dug into the only two parts of television which offer real time content – news and sports. Disney is going head to head with the new streaming providers and brings an enormous production capacity to the fight.

The acquisition will enable Disney to accelerate its use of innovative technologies, including its BAMTECH platform, to create more ways for its storytellers to entertain and connect directly with audiences while providing more choices for how they consume content. The complementary offerings of each company enhance Disney’s development of films, television programming and related products to provide consumers with a more enjoyable and immersive entertainment experience.

Bringing on board 21st Century Fox’s entertainment content and capabilities, along with its broad international footprint and a world-class team of managers and storytellers, will allow Disney to further its efforts to provide a more compelling entertainment experience through its direct-to-consumer (DTC) offerings. This transaction will enable Disney’s recently announced Disney and ESPN-branded DTC offerings, as well as Hulu, to create more appealing and engaging experiences, delivering content, entertainment and sports to consumers around the world wherever and however they want to enjoy it.

Disney expects to save US$2b which may not be much fun for the creatives involved in 20th Century Fox. Given that the Mouse Makers are the consummate creators of family entertainment, and have been very well organised for a hundred years, they make pick through the assets to build something quite different and utterly formidable. We are seeing the end of one titanic fight and the beginning of another.

One thing for local producers: Disney will own National Geographic, which could be a good less weird and more sensible than the revamp created by the Murdochs over the last few years. It could be a more useful partner.

—

Sources: Disney announcement and lots of Wikipedia, which is pretty good on corporate structures.